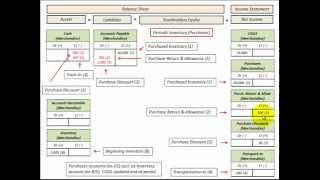

Cash Basis To Accrual Basis Conversion (Inventory Purchases For Cost Of Goods Sold)

Convert inventory purchases from cash basis to accrual basis based on changes in accounts payable and inventory account to convert COGS (cost of goods sold) for inventory from cash basis to accrual basis, example using beginning and end of year balance in each account, calculate change (debit/credit) account and balancing (debit/credit) to COGS account, start with cash payments made in COGS account and (debit/credit) amounts from accounts payable and inventory accounts added or subtracted (what ever the case) determines the accrual basis for inventory purchases (COGS), detailed accounting example with balance sheet and income statement (T Accounts) showing the conversion from cash to accrual basis by Allen Mursau

Похожие видео

Показать еще

HD

HD

HD

HD HD

HD HD

HD

![5 Passive Income Ideas with No Computer [Create Cash, Not Clicks]](https://i.ytimg.com/vi/lkDReVaIsWw/mqdefault.jpg) HD

HD HD

HD HD

HD HD

HD HD

HD HD

HD

HD

HD HD

HD HD

HD

HD

HD

HD

HD HD

HD