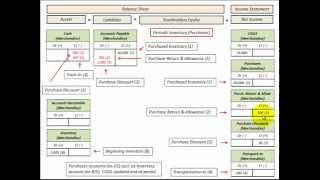

Adjusting Entries For Accrual Accounting (Example Of Each Basic Adjustment Type)

How to make adjusting entires explained and demonstrated using balance sheet and income statement (T Accounts) with actual calculated figures, based on accrual accounting matching principle allocating income and expenditures to the period they actually occur, example will look at (1) preliminary balance, (2) adjusting entry required, and (3) correct balance, adjusting entries require both a balance sheet and income statement account adjustment when made, adjusting entries are classified into four different types, adjust for (1) operating assets & liabilities and (2) adjust for nonoperating revenue & expenses, starting with liability accounts (1) unearned revenue (deferred revenue) and (2) accounts payable (accrued expense), for asset accounts (3) accounts receivable (accrued revenue) and (4) Inventory, Prepaid Assets (deferred expense), use accrual accounting to allocate income and expenses to the period they actually occur, detailed accounting calculations with balance sheet and income statement (T Account) amounts showing adjusting entries for each case stated above by Allen Mursau

HD

HD

HD

HD

HD

HD

HD

HD HD

HD HD

HD HD

HD

HD

HD HD

HD HD

HD![[EN] NACON REVOLUTION PRO CONTROLLER 2 | OFFICIALLY LICENSED PRO CONTROLLER FOR PS4™](https://i.ytimg.com/vi/SCZXOiDz08c/mqdefault.jpg) HD

HD HD

HD HD

HD HD

HD HD

HD HD

HD HD

HD HD

HD

HD

HD HD

HD HD

HD