Bond Issued At Premium Accounting Detailed With Balance Sheet Journal Entries

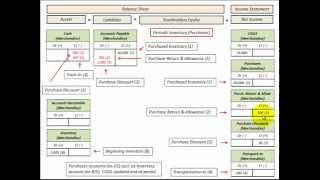

How to record a bond issued at a premium on the balance sheet and income statement, detailed journal entries (T account form), amortize a bond issued at a premium (present value greater than face value of bond) using the effective interest rate method, bond has two cash flows, (1) face value or principal amount paid at maturity and (2) interest payment (usually semi annual) based on the stated rate of interest on the bond, example shown as a cash flow diagram, present value (PV) what its worth when issued (issue date) based on discounting bonds cash flows (maturity value + interest payments) back to issue date using the market rate of interest, comparing the bonds present value to its future value (face value) determines the premium amount on the bond (amount the PV is greater than its face value), the premium amount has to be amortized over the life of the bond using an amortization schedule, detailed example showing how to setup amortization schedule and use the schedule to amortize the bond premium, detailed calculations with accounting journal entries (T accounts)on balance sheet template for bond payable, premium on bond payable, interest payments, interest expense (market rate x carrying value of bond), amortized interest expense (interest payment - interest expense),subtract amortized premium to the bonds carrying value to determine the bonds new carrying value (bond amortization), detailed calculations and accounting by Allen Mursau

HD

HD

HD

HD HD

HD

HD

HD

HD

HD

HD

HD

HD

HD HD

HD HD

HD HD

HD![TOP 5 PREMIUM WIRELESS EARBUDS [Tested & Compared!]](https://i.ytimg.com/vi/-xnr7Inpc-4/mqdefault.jpg) HD

HD HD

HD HD

HD