Notes Payable (Loan) With Accounting Described On Balance Sheet & Income Statement

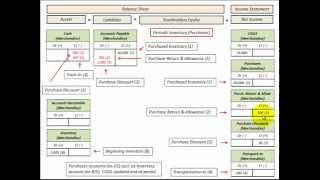

How to amortize and record the discounted notes payable with a lump sum payment (ballon payment) when it comes due using the effective interest rate method (detailed accounting for recording on balance sheet and income statement using T Accounts), calculate the interest expense on the notes payable for the period (duration) of the note, then amortize the interest expense and recognize the expense on the income statement, following steps detailed, (1) discount the note payable (FV) back to the issue date using the interest rate on the note (using Excel PV function), (interest expense = FV lump sum payment - PV lump sum payment), (2) setup debt amortization schedule and amortize the interest expense over the duration of the note, and (3) record on balance sheet and income statement (T Accounts), notes payable, discount notes payable (contra account) and interest expense, detailed calculations for accounting and recording the notes payable by Allen Mursau

HD

HD

HD

HD HD

HD

HD

HD

HD

HD HD

HD